The Necessary Duty of Building Accountancy in Ensuring Financial Precision

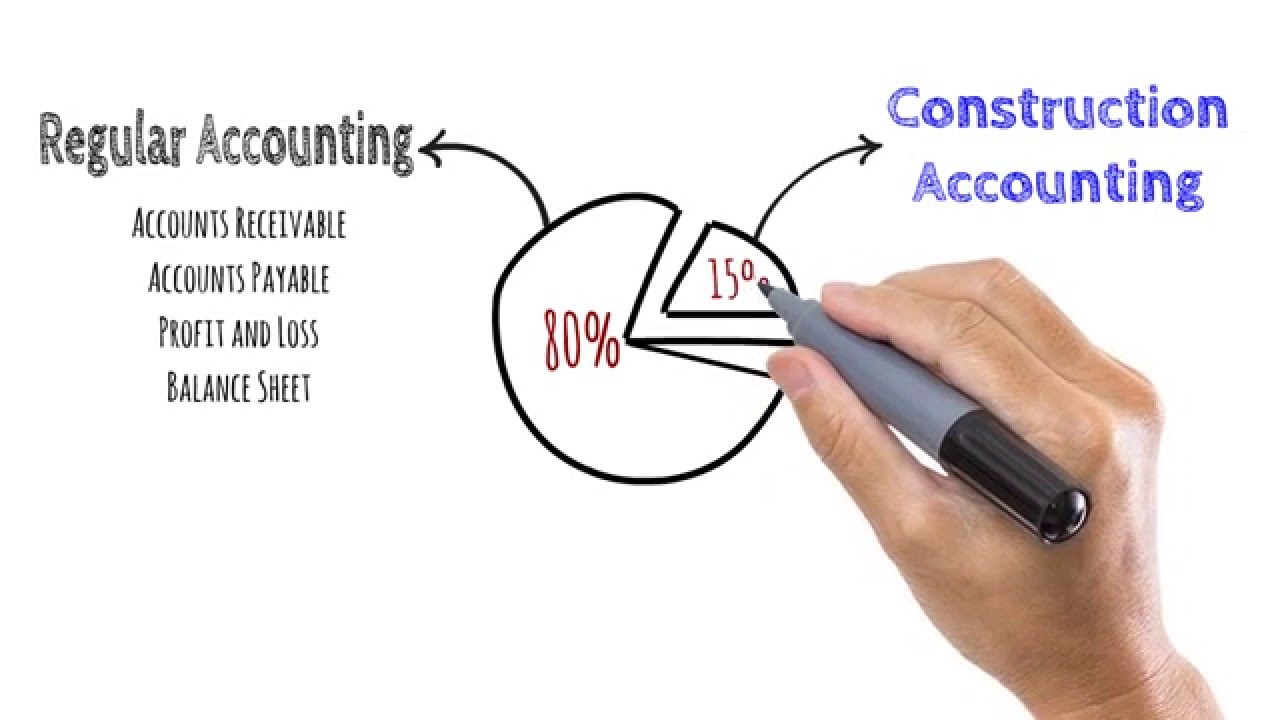

In the complicated landscape of construction monitoring, the duty of construction accountancy arises as a vital element in keeping monetary honesty. By giving a structure for accurate monitoring of costs and earnings, this specialized bookkeeping technique not only aids in reliable job oversight yet additionally improves stakeholder confidence.

Value of Accurate Financial Tracking

Accurate economic tracking is the foundation of reliable building bookkeeping, working as a vital tool for job managers and economic policemans alike. In the very dynamic construction atmosphere, where budgets can rise and fall and timelines can shift, specific financial monitoring ensures that all financial activities are documented and kept an eye on in genuine time. This method makes it possible for stakeholders to make enlightened decisions based on updated financial data, hence reducing the risk of overspending and enhancing task success.

In addition, accurate monetary tracking facilitates conformity with regulative requirements and sector criteria. By preserving detailed documents of costs, incomes, and project costs, building and construction companies can quickly generate necessary documentation during audits and examinations. This openness not just fosters depend on amongst clients and partners yet also minimizes possible lawful concerns.

Secret Elements of Construction Accounting

In the world of building and construction bookkeeping, several essential parts play an essential duty in guaranteeing economic precision and project success. Among one of the most essential aspects is job costing, which includes tracking all expenditures related to a particular task, including labor, materials, and expenses. This procedure allows for exact budgeting and projecting, making it possible for building companies to assess earnings effectively.

Another vital element is modification order administration, which addresses modifications to the original contract. Accurate documentation and tracking of these adjustments are important for keeping task budget plans and timelines. Additionally, financial coverage plays a critical duty, supplying stakeholders with understandings into task performance and general economic wellness.

Capital management is also significant, as it makes certain that the firm has adequate liquidity to satisfy its obligations while taking care of job expenditures. Last but not least, compliance with regulative demands and tax obligation obligations is a critical element of construction accountancy, protecting the firm from lawful consequences.

Effect on Project Management

Reliable building and construction bookkeeping substantially influences task administration by giving critical economic information that educates decision-making. Precise economic documents enable job supervisors to track budgets, forecast capital, and analyze project earnings in real time. This financial understanding is vital for making notified choices concerning resource allowance, subcontractor choice, and job scheduling.

In addition, construction bookkeeping facilitates threat management by recognizing variations between approximated and actual prices. When job supervisors can swiftly determine discrepancies, they can apply corrective steps to mitigate prospective monetary losses. This aggressive method not just assists in keeping task timelines yet likewise improves overall project performance.

Additionally, efficient building audit sustains interaction amongst stakeholders, consisting of clients, financiers, and employee. construction accounting. Transparent monetary reporting fosters trust fund and partnership, ensuring that all parties are aligned on task goals and financial assumptions

Ideal Practices for Financial Accuracy

Developing ideal techniques for monetary accuracy within building and construction audit is essential for making sure project success. An essential method is keeping thorough record-keeping. This consists of tracking this all transactions associated with labor, materials, and expenses expenses in real-time, which helps to recognize inconsistencies early and makes sure that economic information is always approximately day.

One more best practice is carrying out a durable budgeting procedure. Exact budgeting not only helps in projecting task costs yet additionally offers a standard against which real costs can be measured. Routinely contrasting real costs to allocated amounts enables prompt adjustments and far better monetary control.

In addition, conducting regular audits is important. Internal audits can determine possible errors or deceitful tasks prior to they rise, while exterior audits supply an impartial testimonial of financial practices, making certain conformity with market criteria.

Training team in monetary management and accounting concepts is additionally vital. Knowledgeable employees are much better furnished to identify mistakes and recognize the importance of monetary precision in task administration.

Lastly, promoting open communication between task supervisors and economic teams boosts partnership, making certain that monetary choices are aligned with project objectives (construction accounting). These ideal methods jointly contribute to a solid foundation for financial precision in building and construction accounting

Tools and Software Application for Building Accountancy

Selecting the right tools and software application for construction accounting can considerably simplify economic management processes. The intricacy of building and construction jobs requires specific accountancy services that suit one-of-a-kind process, job tracking, and economic reporting demands.

Among the leading software options, Sage 300 Building And Construction and Property (previously Sage Timberline) uses detailed attributes customized to construction organizations, consisting of task management, payroll assimilation, and thorough financial coverage. copyright Desktop, while more basic, provides customizable Continued features that are helpful for smaller building and construction firms, enabling them to take care of invoices, expenses, and pay-roll successfully.

One more noteworthy option is Point of view Vista, which incorporates accountancy with project management, making real-time data accessible for educated decision-making. Procore also attracts attention by providing a robust platform that combines project administration with monetary devices, guaranteeing all elements of a task are synchronized.

Cloud-based services like CoConstruct and Buildertrend offer adaptability and remote gain access to, allowing teams to collaborate seamlessly, despite area. Eventually, choosing the proper software program rests on the particular needs of the construction company, the dimension of projects, and financial restrictions, guaranteeing that financial accuracy is kept throughout the project lifecycle.

Conclusion

To conclude, building accountancy is vital for preserving monetary accuracy throughout a task's lifecycle. By carefully tracking revenues and costs, this customized bookkeeping technique enhances openness, compliance, and notified decision-making. The effective administration of task expenses, adjustment orders, and cash flow not only reduces the danger of overspending however additionally promotes depend on among stakeholders. Inevitably, the execution of robust building accounting practices substantially adds to the total success and monetary honesty of building and construction projects.

Precise monetary tracking is the foundation of reliable construction bookkeeping, offering as an important device for task managers and monetary police officers alike. In the very dynamic building atmosphere, where budget plans can rise and fall and timelines can change, specific economic monitoring makes sure that all monetary tasks are recorded and kept track of in genuine time. In addition, monetary coverage plays an important function, providing stakeholders with understandings right into project efficiency and total monetary wellness.

Accurate economic records enable project supervisors to track spending plans, forecast money flows, and examine task productivity in actual time. Ultimately, the execution of robust building see this here and construction accounting methods substantially adds to the total success and monetary integrity of building tasks.